Sports Value’s recent study of the finances of Brazilian clubs (click here) showed a drop in revenue with sponsorship from Brazilian clubs in 2018.

While the global sports sponsorship market is growing, the Brazilian market does not follow this trend. According to IEG USA, global sponsorships totaled US$ 66 billion last year.

Global corporate investments in sponsorship, especially sports, grow at a much faster pace than conventional advertising and sales promotions.

At this moment, am unique sponsorship deal of a big European team is equivalent to our entire market. Brazil is a global media and entertainment giant, but our clubs are completely out of print on the market.

In 2018 Brazilian clubs saw sponsorship revenues drop 18% as the worst result in history. This represented an actual loss of more than R$ 115 million in one year. We live the worst market scenario and we still lose an important sponsor, Caixa, which according to our analysis represented 20% of the market.

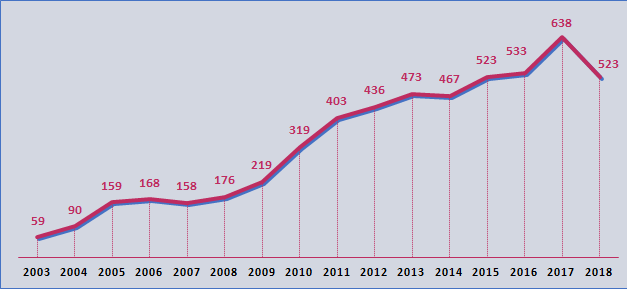

Sponsorship of the Top 20 clubs grew 790% between 2003 and 2018. In the same period the accumulated inflation was 161%. That means real growth of 629% over 16 years.

The average annual growth of the club sponsorship market over the last 16 years was 15% a year. Thanks to the fast pace from 2003 to 2011.

This growth tendency was only interrupted in 2018. Between 2012 and 2018 growth was much more modest and was halted in 2018. And 2017 had been the best performance in recent years.

It is an underserved market but focused on brand visibility only. Uniforms, signs and backdrops are far from the best return on investment in sponsorships.

Now sponsorships represent only 10% of the club’s total revenue, the lowest level since 2003. We go back deeply.

Brand construction in sport is done with integrated actions to the sponsorship investment. Visibility is the gateway to new strategies. In Brazil, unfortunately, it has always been the ultimate goal.

Sponsorship revenues- Top 20 clubs in Brazil- R$ million

Clubs have grown accustomed to stocking branded uniforms, seeking more and more sponsors. But this model was exhausted. Sponsors begin to realize that ROI in sponsorships goes far beyond media return.

Spots Value was born for this purpose, to offer effective ROI for sponsors. Clubs currently suffer from failing to change the current model based on limited assumptions.

Sponsorship needs to evolve into a much broader platform, involving a range of variables, exactly what Sports Value proposes to the clients.

This ROI incorporates a huge range of marketing and communication activities such as media return, commercial actions, engagement campaigns, recurring activations, digital actions, sales promotions and entertainment marketing. (Here it is possible to understand how)

The future of sponsorship in Brazil goes through this brutal change of the current marketing model.

The ROI will only be created if the model is changed.

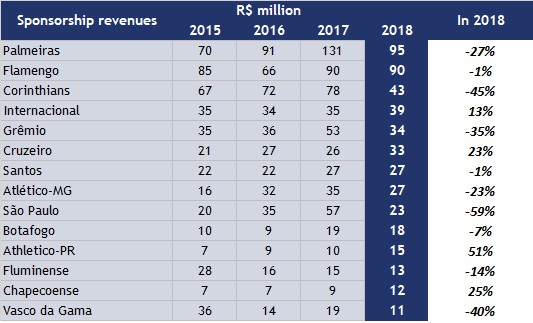

Palmeiras and Flamengo distance themselves from the rest

Palmeiras and Flamengo are consolidated as sponsorship revenue leaders, with R$ 95 million and R$ 90 million, respectively.

Palmeiras reported a 27% drop last year, due to issues related to Crefisa’s resources accounting. Flamengo already presented a drop of 1%.

Corinthians has a huge reduction of 45% and now generates R$ 43 million with sponsorship, the lowest value in a decade.

After these clubs the revenues are very low. In the fourth position, it has International with R$ 39 million, Grêmio R$ 34 million and Cruzeiro R$ 33 million.

Sponsorship revenues – 2015 to 2018- R$ million

São Paulo, being the third fanbase in Brazil and a very strong brand, received only R$ 23 million with sponsorships.

The same with Vasco da Gama with only R$ 11 million in 2018.

According to Sports Value’s projection, with a new sponsorship philosophy in Brazil, developing a promotional work, effective sales actions and fan engagement strategies with sponsorship, the current revenues of R$ 523 million can be transformed into R$ 850 million quietly.

And the sponsors will receive effective return for their business, far beyond the media return.

English - EN

English - EN

Português - PT

Português - PT  Español - ES

Español - ES