Sports Value has just completed a unique analysis in the world of sports. The revenues generated by the main sports competitions worldwide over the past eight years were analyzed.

The company boasts the largest database on the planet for leagues, teams, competitions, and various global financial data.

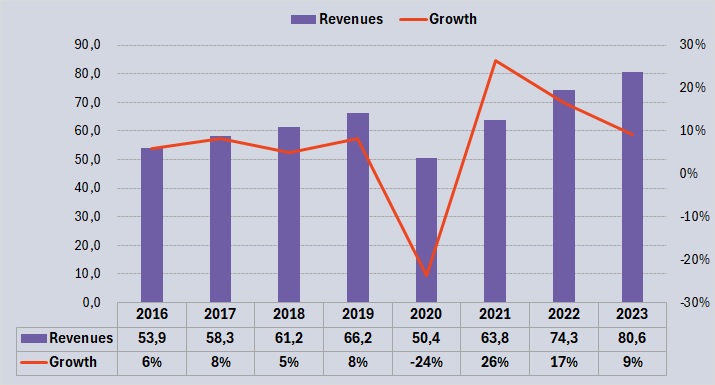

There are TOP 14 leagues with annual revenues of US$ 80.6 billion in 2023. The combined revenue was US$ 66.2 billion in 2019, before the pandemic.

During this pre- and post-COVID-19 period, revenue growth was 22%.

Revenue Evolution – 2016-2023 – Major Global Competitions – US$ Billion

When considering the revenues of the IOC from the Olympic Games and FIFA from the World Cup (4-year cycle), the value of the world’s most important competitions reached US$ 97,6 billion.

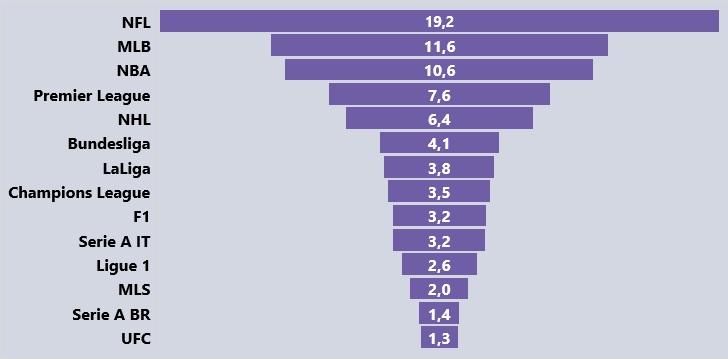

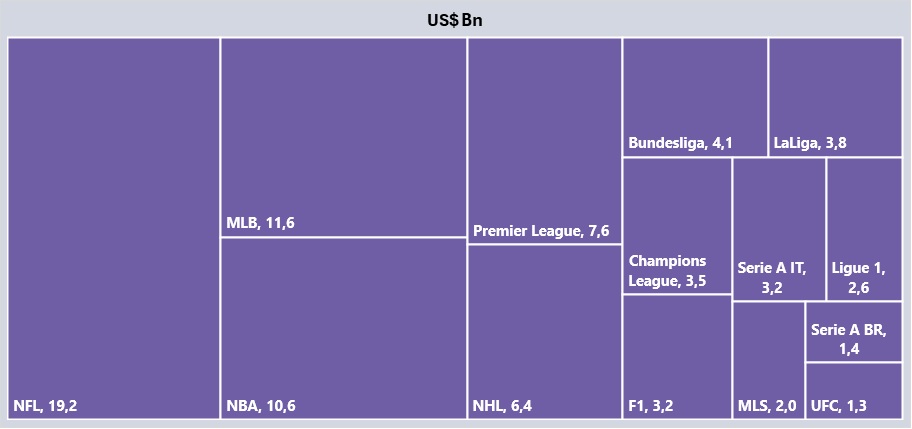

Major Annual Global Competitions in 2023 – US$ Billion

The TOP 5 US Leagues represented 61% of the total in 2023.

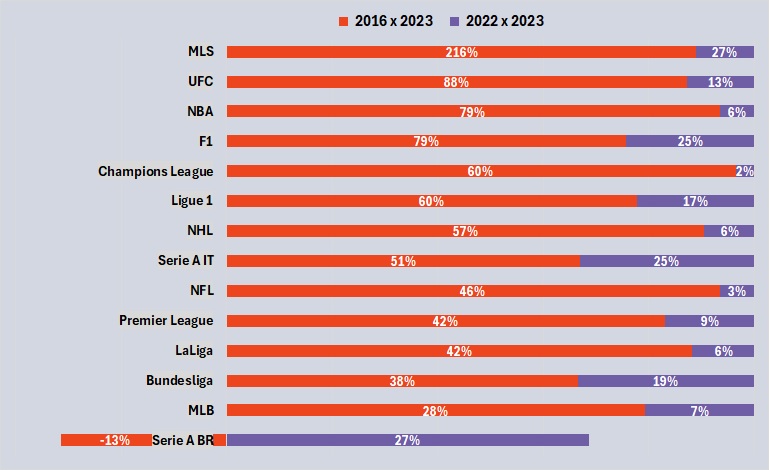

Leagues with the Highest Growth – From 2016 to 2023 – In %

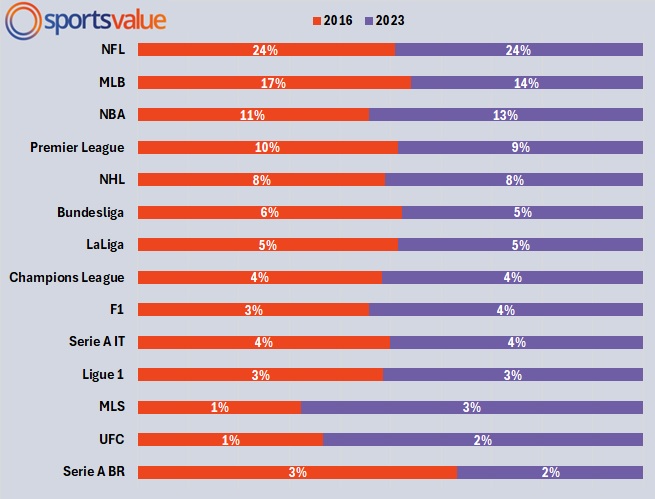

Analyzing these last eight years, in general, the leagues maintained their share of the total generated globally.

Some leagues grew in share of the total, such as the NBA, F1, and UFC. Others lost importance, such as MLB and Brazil’s Série A.

Share of the Global Total Generated 2016 vs. 2023 – In %

Here are the revenues of each of the 16 most important competitions on the planet.

Players transfers revenues are not considered.

#1 NFL US$ 19.2 Bn

The NFL, the American football league in the USA, is consolidated as the world’s largest league in terms of revenue. Although it has less global viewership than soccer leagues, it dominates interest in the USA, especially among those with high purchasing power. The league’s goal is to reach US$ 27 billion in annual revenue.

Revenues US$ Bn

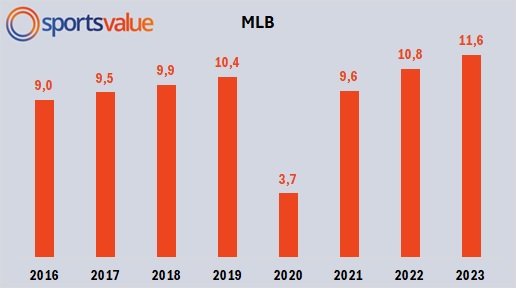

#2 MLB US$ 11.6 Bn

MLB, the American baseball league, remains the second most relevant league in terms of revenue but is losing importance. The younger population shows disinterest in the long duration of each game. The league, which heavily depends on game days, was the most impacted by the pandemic. The league’s future is to grow in new markets in Asia and Latin America.

Revenues US$ Bn

#3 Olympic Games US$ 10.8 Bn

Although the Olympic Games are not annual like other competitions, their economic relevance places them as the third largest in the world, considering their 4-year cycle. The value of broadcast rights for the Games already moves US$ 4.5 billion and spososrships surpassed US$ 6 billion for the first time.

Revenues US$ Bn

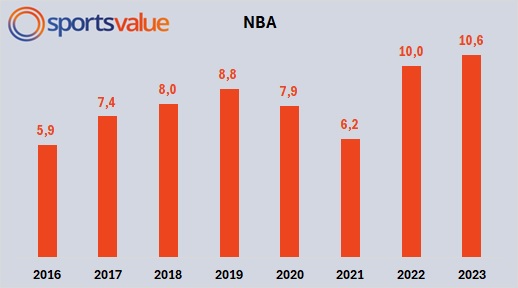

#4 NBA US$ 10.6 Bn

Among US leagues, the NBA has best exploited the global potential of its business. The league’s revenue stands at an impressive US$ 10.6 billion, compared to US$ 5.9 billion in 2016. The strength of the US market, along with its expansion into the Chinese, European, and Latin American markets, makes the NBA the most disruptive league today.

Revenues US$ Bn

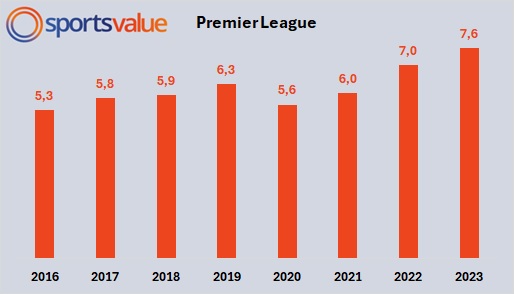

#5 Premier League US$ 7.6 Bn

The Premier League is the soccer league that has best exploited the global impact of its business. The English league makes 53% of its TV revenue outside of England. It is very strong in Asia, the United States, Europe, the Middle East, Latin America, and Oceania. Teams operate in these markets with sponsorships and product sales.

Revenues US$ Bn

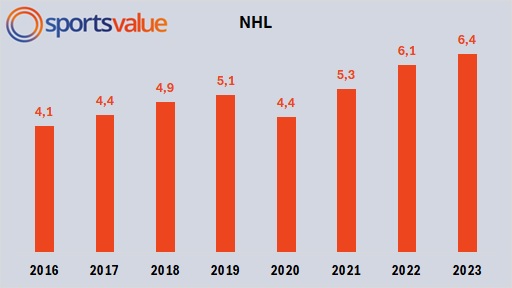

#6 NHL US$ 6.4 Bn

The NHL has always been the fourth league in the USA and has recently experienced changes in its fan profile. The main audience for hockey is 35-44 years old, much younger than older generations. With actions on social media and strong digital engagement, the league has grown significantly among younger audiences and women. Currently, 37% of fans are women, and the second most relevant target now is 18-34 years old.

Revenues US$ Bn

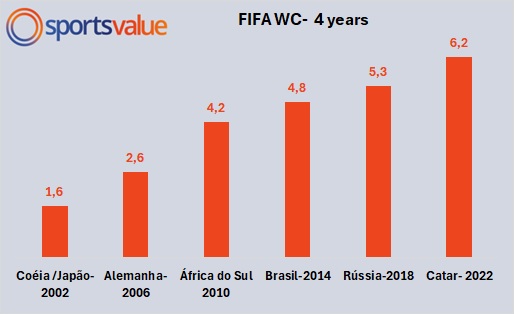

#7 FIFA World Cup US$ 6.2 Bn

Like the Olympic Games, this event appears on the list but is held every four years. Compared to the leagues and the Champions League itself, it generates modest values. Comparing four seasons of the Champions League equals US$ 14 billion compared to the total revenue of the 2022 World Cup of US$ 6.2 billion. FIFA takes a small share of the global football industry. FIFA is looking for new revenues and the new Club World Cup will help a lot.

Revenues US$ Bn

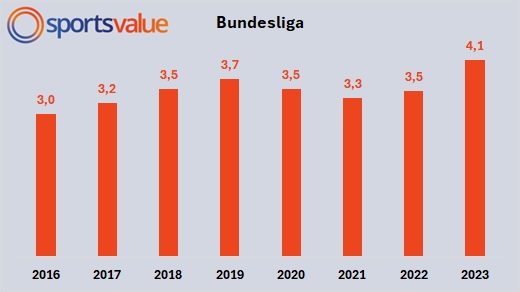

#8 Bundesliga US$ 4.1 Bn

The league is fiercely competing with Spain’s LaLiga for the second spot in European soccer. It should generate much more revenue, being the largest consumer market in Europe, but the 50%+1 model regulates investments. It also has a lower global impact from many teams, hindering growth. Bayern Munich and, more recently, Borussia Dortmund have the most appeal. Actions targeting young audiences and investment in the US market are key factors for future growth.

Revenues US$ Bn

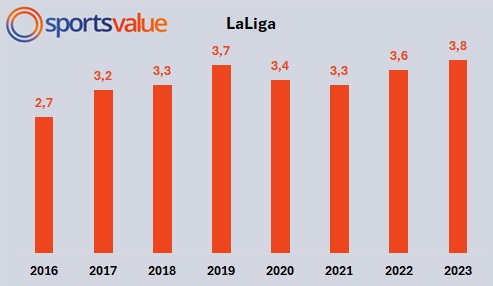

#9 LaLiga US$ 3.8 Bn

LaLiga can be considered a success story in the sports world, with significant growth thanks to the league’s collective vision and effort. When Real Madrid and Barcelona agreed to follow a league model looking out for everyone’s interests, the numbers soared. Teams like Atlético Madrid, Sevilla, Athletic Bilbao, Real Betis, and many others have evolved. Strong investment in key markets such as Asia, the USA, and Latin America, along with a focus on the digital environment, has boosted business.

Revenues US$ Bn

#10 Champions League US$ 3.5 Bn

The Champions League is another commercial success, generating high values from TV rights and sponsorships. Only a portion of the revenue goes to participating clubs, with over US$ 1 billion generated by the competition going to UEFA for other uses. This creates tension between the clubs and the entity, as seen with the recent Super League case. Aggressive sponsors like adidas, Heineken, and Lay’s have helped increase the Champions League brand’s global impact.

Revenues US$ Bn

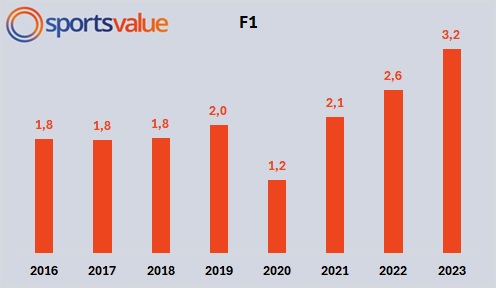

#11 F1 US$ 3.2 Bn

The top category in world motorsport had been struggling with an aging audience and a stagnant business. Since its acquisition by Liberty Media and the accelerated changes brought by the pandemic, F1 has reinvented itself. The partnership with Netflix for the series “Drive to Survive,” focus on eSports, and strong expansion into the US market were crucial for growth. The brand has grown significantly among young people in the USA, becoming a key market.

Revenues US$ Bn

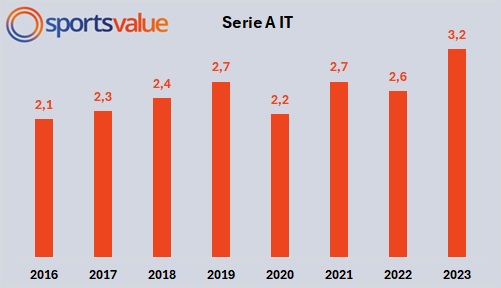

#12 Serie A Italia US$ 3.2 Bn

Italy’s Serie A, which was the European leader in revenue and investment in the early 1990s, has lost ground to the Premier League, Bundesliga, and LaLiga. One reason for this decline was the “family holding” model of many major clubs, lacking professional management. Lower international appeal and the loss of stars to other leagues also weighed in. The model of international investors, especially from the USA, has shown to be extremely positive for Italian football.

Revenues US$ Bn

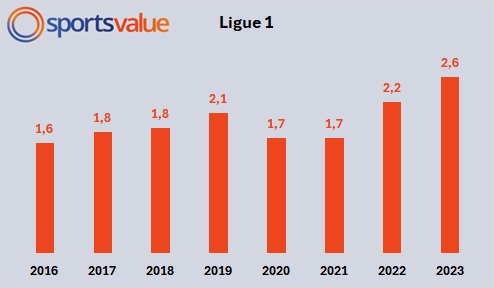

#13 Ligue 1 US$ 2.6 Bn

France’s top division league has seen great growth in recent years. The main factor was the arrival of the Qatari fund that acquired PSG. The investment in the Parisian club is disproportionate to the size of the league and other teams. PSG represents almost 35% of the league’s revenue. While PSG has annual wages of US$ 680 million, second-placed Olympique Lyon spends US$ 170 million. The competition has become uninteresting, as only one club is generally expected to be champion. Like LaLiga, sooner or later, Ligue 1 will have to change this model.

Revenues US$ Bn

#14 MLS US$ 2.0 Bn

The USA’s soccer league has been the fastest-growing league in the world over the past decade. The evolution was the sum of new teams’ expansion and the growth of game day and sponsorship revenues. The US soccer market now has more than 115 million fans. The TV contract with Apple increased TV rights from over US$ 100 million annually to over US$ 250 million. Messi’s arrival at Inter Miami gave a new boost to MLS, which reached 30 teams with the new San Diego franchise. The league went from 1% of the global volume generated by competitions to 3% of the total.

Revenues US$ Bn

#15 Serie A Brazil US$ 1.4 Bn

Brazil’s Serie A is the largest potential to be explored in the global sports industry. Broadcast rights in 2023 totaled US$ 653 million for the elite of Brazilian football. The drop in dollar revenue in recent years is due to the devaluation of the Real. The market still faces a reality of low professional management. The lack of a league, amateur/political management by the CBF, and disunity among clubs hinder revenue growth. The market is highly dependent on transfers, which reached US$ 400 million in 2023. Including transfers, Serie A’s revenue reached US$ 1.8 billion. The creation of two parallel leagues and maintaining the current chaotic calendar are obstacles to future market growth, especially abroad.

Revenues US$ Bn

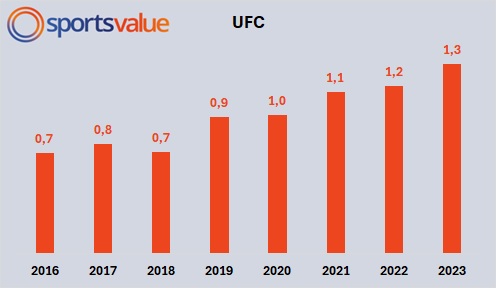

#16 UFC US$ 1.3 Bn

Another competition that has shown strong global expansion is the UFC, acquired by the Endeavor group. Post-pandemic, revenue acceleration and the sport’s expansion have been evident. Broadcast rights moved US$ 811 million in 2023, sponsorships surpassed US$ 196 million, and event revenues were US$ 168 million. The UFC doubled its representation from 1% to 2% of global competitions.

Revenues US$ Bn

English - EN

English - EN

Português - PT

Português - PT  Español - ES

Español - ES